By Daniel Geey. Daniel works as a solicitor for Field Fisher Waterhouse LLP and advises entities wishing to invest in the football industry, specifically in relation to the ‘fit and proper person’ test, conflicts of interest, multiple club ownership and third-party player ownership. He is also a subscriber to The Tomkins Times.

The aim of this article is to set out briefly the rationale for the new UEFA rules, then go into a little bit of detail about what they say, and then offer some insight into their significance for Liverpool Football Club. The article will try and demonstrate that, in the short term at least, due to the unfortunate timing of the proposed takeover and the lack of any significant funds in the last few transfer windows, Liverpool Football Club has not been able to take advantage of the UEFA rules used to calculate whether a club has broken even. There is no coincidence that Manchester City are spending fortunes this summer, because from the 2011/12 season, as will be described below, the club runs the risk of breaching the UEFA rules by spending over and above what they earn.

Background

UEFA and its president, Michel Platini, have long been concerned that clubs who continually make losses and, as a result, accumulate debt are not playing by the rules of fair competition. The Premier League, and in particular its chief executive, Richard Scudamore, has been wary of lessening the global attractiveness of the Premier League by curbing the ability of owners to subsidise their clubs or, in some cases, milk their clubs dry. Tellingly, however, UEFA has implemented, as part of its already functioning club licensing system, the Financial Fair Play Rules (FFPR) to ensure a club, more or less, has to balance its books.

UEFA’s overall aim for the FFPR is for its affiliated football clubs to balance their books, not spend more than they earn, and to promote investment in their stadia and training facility infrastructure and youth development. This idea of self-sustainability relates to UEFA’s underlying belief that transfer fee and wage inflation continues unabated because each set of new club owners injects more money into the European football club market. This ‘keeping up with the Joneses’ effect spirals further because a new owner then has to outbid other high-spending clubs.

Whilst the beneficiaries are no doubt the players who are earning ever more lucrative salaries, the clubs (through their representative ECA body) have been seeking ways with UEFA to actually limit their own spending. This may seem rather ironic in the case of Chelsea, given their £120m loss in 2004, but it actually makes perfect sense; Mr Abramovich, after spending over £700m, sees the fallacy of football clubs constantly outdoing one another. The very clubs that are being restricted by these rules are the ones that have actively participated in, and consented to, the proposals. Clubs are asking UEFA to save them from themselves. UEFA, along with the various interest groups, put forward proposals in order to create a deflationary effect across UEFA affiliated national football associations.

The Basics

It should be borne in mind that the new FFPR relate only to Champions League and Europa League, and not to domestic league, participation. Each club that believes it can qualify for that season’s European competitions must, prior to the beginning of that season, apply for a UEFA Club Licence. From the 2013-14 season, the licence stipulations will include adherence to the FFPR. Until the 2013-14 season, there are no sanctions for breaching the FFPR.

The FFPR will therefore start to bite from the 2013-14 season. The rules need to be borne in mind from the 2011-12 season onwards because the 2011-12 and 2012-13 season accounts are used to determine a club’s licence application in the 2013-14 season. For Liverpool, it means the club is unlikely to take advantage of the loophole that clubs like Manchester City are using for their benefit (i.e. buying this season so transfer spending does not appear in their 2011-12 accounts). Manchester City may still have break-even problems if their wage bill is as astronomical as most newspapers speculate.

The rules also encourage investment in youth development and infrastructure. Such infrastructure includes stadium and training ground development and expenditure in a club’s academy. Any club has the incentive to spend in these areas, should they wish to participate in European competition, because the FFPR does not count such investment as expenditure for the purposes of its break-even calculation. Therefore, any new funding for the proposed Stanley Park stadium will not impact on Liverpool’s ability to pass the FFPR because such finance would be excluded.

As any potential stadium is not included in UEFA’s break-even calculation, Liverpool’s next owners will be free to plant the first shovel in the ground, safe in the knowledge that higher levels of income will be generated which should aid Liverpool with their break-even requirement. The greater the commercial revenue growth funded by long-term infrastructure investment, the larger the revenue to balance against expenditure.

UEFA has also been at great pains to stress that they are not anti-debt. With Manchester United’s huge reported debt and our own debt inching towards it, Platini placated various debt-ridden clubs with the distinction that so long as the debt is being serviced (i.e. profit is covering interest payments) UEFA does not have a problem. Issues become more delicate when interest payments to service the debt do not cover the profit made. Sound familiar/worrying? From Liverpool’s latest published accounts, its trading profit of £27.4m fell someway short of the £40.1m required to service the interest payments due. The latest accounts certainly show Liverpool Football Club in the wrong type of red.

Acceptable Deviation = Break Even (ish)

A few important points to bear in mind. Usually, break-even means expenditure must equal revenue. Not in this case; at least at the outset of these rules. This is because included in the break-even calculation are the acceptable deviation provisions (code for a little bit of a loss is acceptable in the first few years). Clubs will not have to break even until 2018/19 season at the earliest.

The revenue that is taken into account for break-even purposes includes gate receipts, broadcasting rights, commercial sponsorship details and profit on player transfers. Expenditure includes player transfers, wages and associated costs and other operating expenses. There are also anti-evasion mechanisms like arms’-length trading and related-party transaction requirements.

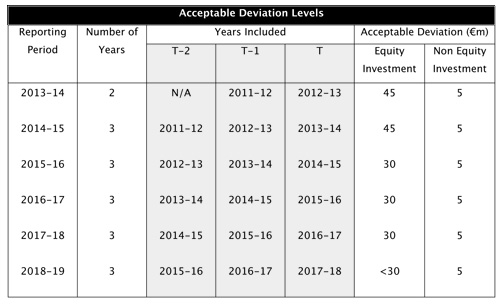

The acceptable deviation provisions allow a club with some losses over a certain number of seasons to ‘break even’ and therefore pass the FFPR. Without trying to get too technical, below is a table that I have amended slightly from an excellentSwiss Ramble blog on the FFPR.

In taking the first row as an example, the rules come into force in the 2013-14 season. The reason why this is important is because, in the first year, two years’ worth of accounts are used to assess whether a particular club can successfully apply for its UEFA Club Licence.

Therefore, a club’s accounts for years 2011-12 and 2012-13 are used to determine the licence application. This is crucial because the present 2010-11 season accounts are not taken into account. The reason why Manchester City are investing so heavily now in their playing squad is because the overinflated transfers will show up as major expenditure only in their year-ending 2010-2011 accounts. Should they spend this type of money in the next summer’s transfer window (for the 2011-12 season (T-1)), such spending would be taken into account for the break-even calculation, which could have a damaging effect on being granted a UEFA licence.

Indeed, the FFPR may signal the end of the mega transfer because a club may simply not be able to afford a £50m fee and then break even. This is of course unless a club makes big commercial profits, which very few clubs (bar Arsenal) have done recently.

Strategically, if Chelsea or Manchester City want to buy Torres at a figure around £50m-60m, they would probably have to do it during this, or the January, transfer window. This would keep the Torres transfer off their 2011-12 season balance sheet. Otherwise, from the 2011-12 season onwards a club would have to make windfall revenues from their commercial activities (or sell another top player) to afford a marquee signing like Torres to balance the books. (Note: it may be possible to take a loan to fund a large transfer so long as the interest repayments do not send a club into the red.)

The table shows that the acceptable deviations (i.e. losses) vary quite considerably. From the 2013/14 season when the rules practically come into force, an owner can invest up to €45m over two seasons in exchange for more shares in the club. It means that after the 2013-14 season an owner can on average exchange only €15m worth of cash for shares each year to spend on transfers and wages, etc. That figure is reduced to €10m per season (€30m over three seasons) for the 2015-16 season. If an owner does not put any money into a club by way of cash for shares, each club’s acceptable loss (by reference to the last column in the table) is a mere €5m over three years.

Sanctions

The Club Financial Control Panel will conduct club audits to ensure that the system is applied correctly. If the Panel believes that the FFPR have not been fulfilled, it can refer the case to the strangely named Organs for Administration of Justice, with the ultimate sanction being a ban from UEFA competitions [and harvesting of your kidneys? PT].

The UEFA Disciplinary Regulations do provide for a whole host of possible sanctions including a reprimand, a fine, disqualification from competitions in progress and/or exclusion from future competitions or withdrawal of a licence.

Although the above are all possible sanctions, it appears likely from the outset (from the 2013-14 season) that a soft-touch approach may well be applied, simply because these rules were in part drafted by the clubs not wanting harsh sanctions for breach of the rules. This is unless presumably there is a blatant flouting of the rules (i.e. someone posting a loss similar to Chelsea’s £140m loss in the 2004/5 season).

Why a soft-touch approach? Because there is nothing set in stone in the rules which says a club falling outside of the break-even parameters will automatically have its licence refused. Indeed there is even a provision where clubs can be in breach of the break-even calculation and still not be sanctioned at all! (Annex 11(2) for those wanting to know where to look).

It should be borne in mind that Real Mallorca have, at the time of writing, been refused entry into this season’s Europa League because they failed to meet the UEFA Club Licensing entry criteria. This decision can however be appealed to the Court of Arbitration for Sport.

Such an instance does illustrate the powers UEFA has to refuse a club licence application. When the FFPR get added to the licence criteria in time for the 2013-14 season, the rules will be stricter than those applied to Real Mallorca. A future high-profile UEFA refusal of a club licence application should not however be ruled out.

What does this all mean for Liverpool?

Short-Term Significance

Before the impending ownership changes were mooted, this piece was very much a ‘missed opportunity’ article. This was because I thought it highly unlikely that the current owners would either authorise a spending spree or sell before the transfer deadline with enough time for someone else to invest heavily. I presume that this will unfortunately still be the case.

As already mentioned, transfer spending completed before the 2011-12 season (as the first accounting period UEFA uses to measure the break-even test) would not be included in the UEFA FFPR calculations. Any large transfer spending, if it is not done in this summer or winter transfer window, would be taken into account by UEFA.

That is why it is so imperative for Liverpool, if they are going to get any transfer money from the new owners, to spend it quickly (and wisely!).

Longer-Term Significance

I may be proved wrong but this is where I believe the rules are in Liverpool’s favour. Unlike smaller Premier League clubs who will probably have only a finite level of commercial income (mid-range stadium capacity, merchandising sold only in the local area, limited commercialisation of overseas markets), Liverpool are one of only a small number of global football institutions that have the ability to expand their international commercial activities.

Additionally, and most importantly, the club has the potential for a much larger stadium to bring vastly increased revenues. Liverpool’s annual match-day income from their latest accounts of £42.5m is dwarfed by Arsenal’s £100.1m and Manchester United’s £108.8m in revenues. Being debt-free (a big ‘if’) and having £60m worth of additional revenue each season creates a much larger revenue stream with which to break even.

Therefore, in the long term, Liverpool’s hopefully increasing international commercial performance (perhaps into China) along with the potential revenue windfall of a new stadium should allow the Reds to keep within the rules by having larger revenues to balance against larger transfer spending.

Liverpool’s global following should give the club a disproportionate revenue advantage when compared with probably all but two or three other Premier League clubs. The fact that Liverpool are 7th (measured by revenue) in the Deloitte Football Money League 2010 for Europe shows the potential for further revenue growth.

"transfer spending completed before the 2011-12 season ... would not be included in the UEFA FFPR calculations"

ReplyDeleteThis isn't exactly correct as transfer fees are amortized over the life of the player contract. Take Carroll as an example, his 35 million transfer isn't fully accounted for this season, but over the life of his contract which is 5.5 years. So before the 2013-14 season begins, Carroll's transfer will still represent 22.3 million in the expenditure column.

This is a great inspiring article.I am pretty much pleased with your good work.You put really very helpful information. Keep it up. Keep blogging. Looking to reading your next post. https://bongdat.com/tin-tuc.html

ReplyDelete